Verso in figures

What we look for

- European B2B companies

- Unique value proposition

- Revenues of €10-90m

- Opportunity for sustainable growth

We are an active partner helping to achieve sustainable growth

Buy-outs

We are typically the largest shareholder in our portfolio companies and spend a significant amount of our time working together with the management team to accelerate growth and optimise the business

Carve-outs

With more than 100 carve-outs and M&A transactions managed by our team, we have extensive experience in building and executing even the most challenging carve-outs quickly and effectively

Management Buyouts (MBO)

Our dedicated team collaborates closely with talented management teams to unlock the full potential of companies, fostering sustainable growth and long-term value creation. We forge lasting partnerships, ensuring a seamless transition of ownership for optimal value creation. Verso can act as a partner early on in the process to discuss structure, tactics and a way forward.

Sustainability

We believe sustainability is a natural part of international business processes, as companies are increasingly expected to be responsible members of the global society. With a growing number of companies investing in sustainability, we are particularly interested in companies benefiting from the following themes:

- Environmental impact

- Energy efficiency

Portfolio

Selected active investments

Joyweek

Nextfour

Vetrospace

Everon

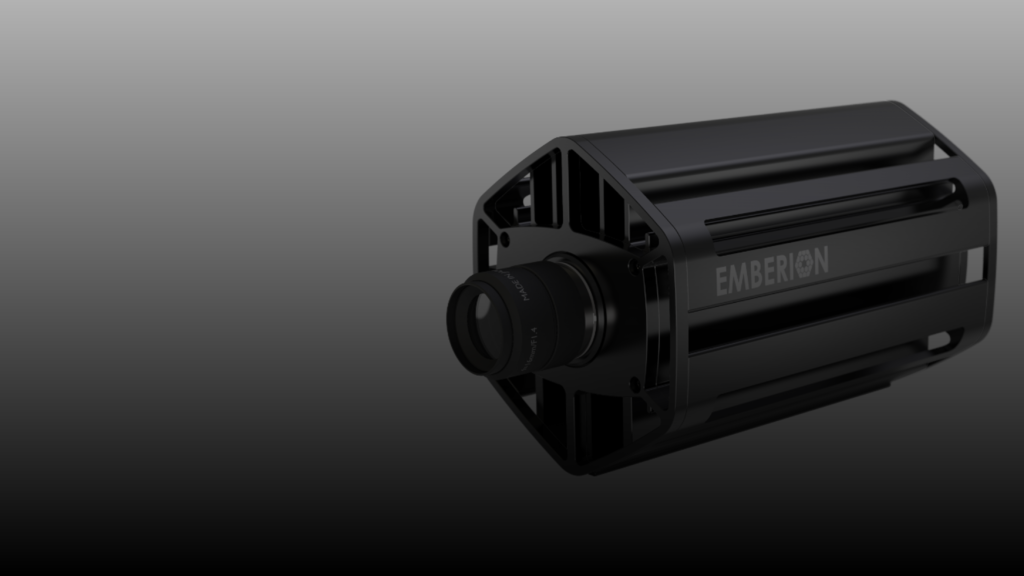

Emberion

Atrinet

Meet the team

Experienced professionals with diverse operational and financial backgrounds

Verso Capital’s team members have diverse international backgrounds in senior management positions, private equity, investment banking and venture capital